Managing global supply chains, riskier emerging markets’ exposure, dynamic cost structures, and a move from product-driven to “solution driven” value propositions challenge some of the leading manufacturers to maintain growth.

To augment growth, leading organizations have sought to institutionalize and streamline their inorganic strategies to augment traditional operating excellence. A leading organization engaged Red Chalk Group to evaluate the Oil & Gas adjacency and formulate a strategic growth plan on the opportunity.

Approach

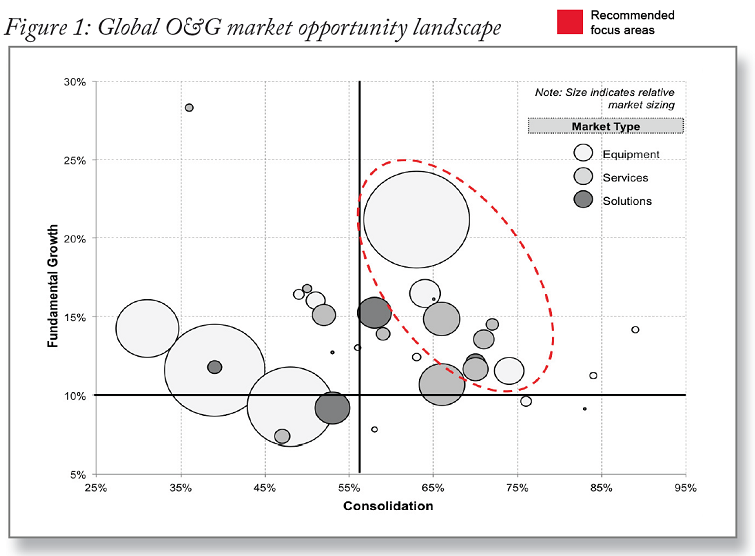

To understand the opportunity landscape, it was critical to first disaggregate the market segments across the entire value chain, fundamental structure, and growth profile.

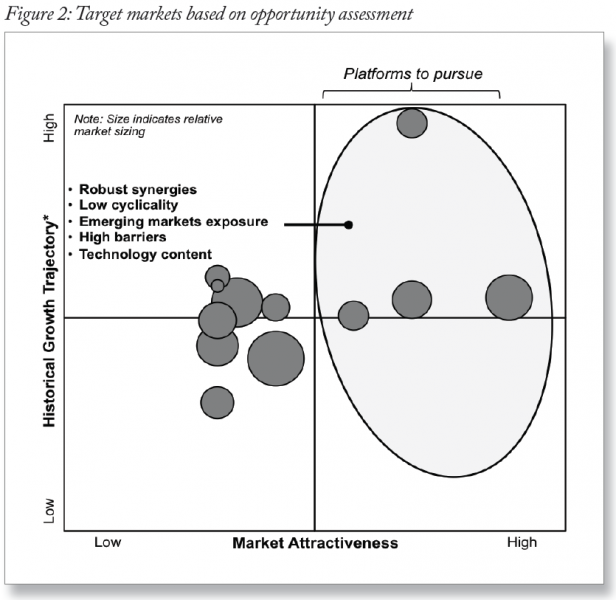

We then employed a strategic framework consistent with our client’s portfolio management and broader strategic goals. This “fundamentals” based assessment methodology led to a narrower set of four target markets.

After target market identification based on the frameworks employed, the analysis led to a deeper diligence phase. This phase was key in developing ultimate client recommendations and involved industry “channel checks” along with financial, strategic, and operational diligence. The diligence phase resulted in the following:

- Nature of market engagement confirmed as M&A

- Deep understanding of the structural industry characteristics inclusive of demand drivers, cyclicality, competitive dynamics, profitability, and growth augmentation

- Recommendations on specific M&A targets with supporting “deep-dive” diligence

- Synergies with existing client platform offering

Client Impact

Red Chalk Group’s recommendations offered the C-Suite with multiple attractive growth platforms that represented true adjacencies and facilitated management’s deal-making focus with several M&A targets to take to the Board.